Homeownership

Habitat for Humanity of Kitsap County partners with local families to help them build and buy safe, decent, affordable places to call home.

Take Your First Step Toward Homeownership!

Attend a homeownership orientation session. These sessions are held via Zoom.

Wednesday, April 2, 2025 at 12:00 p.m.

Wednesday, April 23, 2025 at 3:00 p.m.

Program Eligibility Criteria:

Need

Candidates for homeownership must demonstrate a need for safe, affordable housing. Examples include the following:

- Paying unaffordable rent.

- Living in an overcrowded space.

- Living with family or friends.

- Living in an unsafe or unhealthy environment.

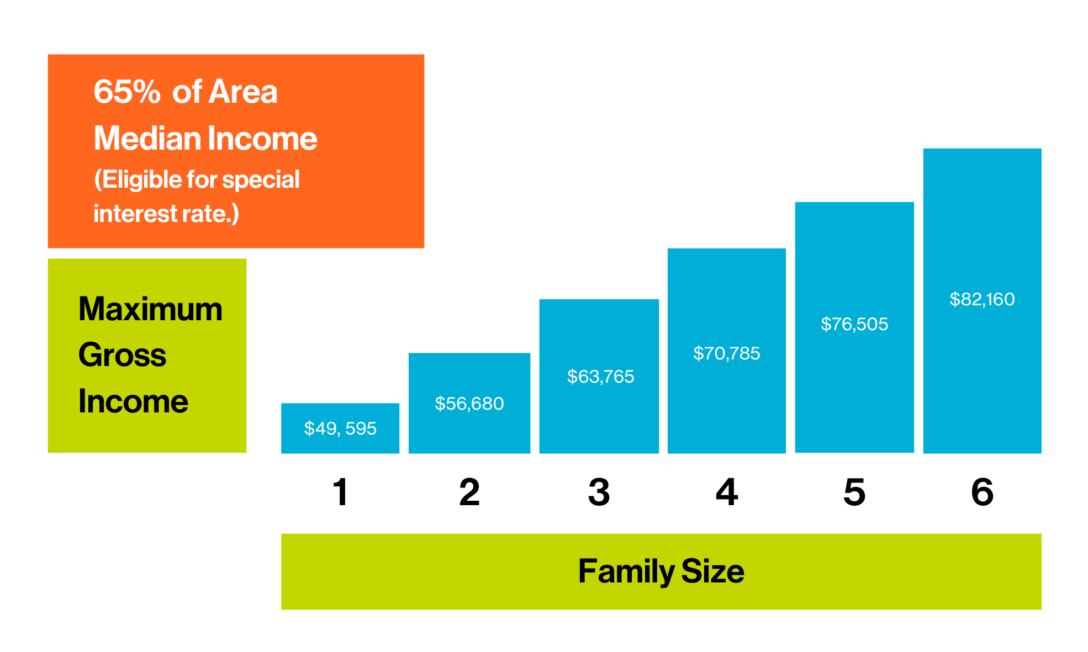

Candidates’ income cannot exceed 65% of the gross median income, based on household size.

Ability to Pay

Candidates must be able and willing to pay an affordable mortgage.

- Candidate must obtain pre-approval for a fixed-rate, fixed-term mortgage from a third party lender (FDIC insured or DFI verified).

- Candidate’s monthly recurring debt must not exceed 13% of their monthly gross income.

The amount of the mortgage (including property taxes and insurance) will not exceed 38% of a homeowner’s monthly gross income.

Willingness to Partner

Candidates must be willing to partner with Habitat throughout the application, selection, building, and buying processes.

- Investing 100 hours of sweat equity into the building of their home and the homes of others.

- Communicating honestly and consistently with Habitat staff throughout the process

- Attending required homebuyer education classes.

First-Time Homebuyer

Candidates must be first-time homebuyers. This is defined as not having owned a home in the past three years.

Residency

Candidates must have lived or worked in Kitsap County for the past twelve consecutive months.

Candidates must be U.S. citizens or permanent U.S. residents.

Other Considerations

Candidates must not have any open collections, judgments, or liens.

Any foreclosures must be seven years from the date of application.

Bankruptcies must be discharged at least four years from the date of application.

HOA/COA Membership

Habitat homes are often part of a homeowners’ association or condominium owners’ association. This means that there are common areas such as streets, parking areas, and green spaces that are maintained by those owning homes in the community. This maintenance is financed by fees paid by the homeowners on a monthly basis. Habitat homeowners should expect to pay $50 to $150 per month in fees. Cost varies by community size and location.

For more information:

Contact homeowner services: